Table of Content

If your income is higher than the median income, you can only purchase in “priority areas.” These are low-to-moderate income housing communities. NACA, on the other hand, doesn’t rely on credit scores. Instead, the program examines your payment history over the previous 12 months. With most mortgage programs, you typically need a minimum credit score of 580 to 620 to qualify.

Once you’re NACA-qualified, you’ll attend a home purchase workshop to learn more about the home buying process. You’re also assigned a real estate agent who you’ll work with to find a home within your budget. The only exception is if you’re buying a multi-family home. You can live in one of the units and rent out the others. Before qualifying, though, NACA requires completion of a “recognized” landlord training course.

Ways to get assistance with your down payment

It also prohibits discrimination against homebuyers or sellers based on their citizenship status. Rather, it works with private mortgage lenders to provide funding for borrowers. Currently, Bank of America is NACA’s largest partner and the only financial institution it uses to create loans. In the past, NACA has had partnerships with Fleet Bank and CitiMortgage. They have always been eligible for some conventional loans, subject to lenders’ policies, including conforming ones that are offered by Fannie Mae. Before you settle for the first loan option that presents itself to you, use this guide to explore your options and get the best deal.

NACA will require that you save an extra $300 every month before you’re qualified. You must keep this money in savings throughout closing. If your mortgage payment will exceed your current rent, you’re required to maintain a “payment shock” savings to compensate for the payment difference. Also, NACA limits a borrower’s mortgage payment to no more than 31 percent of their gross monthly income.

Which DACA home loans are best for you?

When it comes to applying for a home loan as a DACA recipient, you’ll find that the homebuying process is not as intimidating as it might seem at first glance. At Supreme Lending, the Loan Officers of Team Martilla have extensive experience with the DACA recipients and can guide you through the loan process. Our FHA home loan program team will ensure that all the necessary steps are complete to help make your dream of homeownership come true as quickly as possible. Let’s say you pay $1,000 per month for rent, but your new mortgage payment will be $1,300 per month.

Our customers can back us up on this one—we know how to get your loan quickly. Our team of experienced lenders is dedicated to helping you get your mortgage. We’ll work with you one-on-one to gather the right information and see if we can finance or refinance your home, even when other lenders have said no. As a free tool to give you all the loan information you need ahead of time. The following chart shows you how much money you'll need for the down payment. If you’re a DACA recipient who wants to own a home in the U.S., the good news is that it’s possible.

Shop for loan options and mortgage rates

FHA also requires that the property be your primary residence, meaning you must plan to live there full time. Official policy before January 19 was that DACA recipients were ineligible for FHA loans. The FHA has strict lending limits on any support provided. The limits do change over the years to keep up with inflation, so always check for the most recent limits. If you’re looking to take advantage of this lending option, you’ll need to keep the limits in mind while shopping the market.

Your financial support helps us make affordable homeownership a reality for thousands of each year. Cash investors are stealing the dream of homeownership. Help us campaign against corporate real estate investing. So a DACA borrower needs to seek out the type of loan that best suits their personal financial circumstances — just like everyone else. Freddie’s guidance uses language that was similar to the FHA’s old wording.

So, once you find a home and apply for a mortgage, you’re going then want to take advantage of any existing assistance programs and put together money for your down payment. There are currently no home assistance programs specifically designed to assist dreamers in buying a home. As a DACA recipient, you may qualify for non-specific homebuying programs Such as National Homebuyers Fund or First Home Club from Quontic Bank. Current estimates put nearly 700,000 individuals in the DACA program. With many of these young adults aging into traditional American milestones like homeownership each year, it makes sense for DACA recipients to investigate options for buying a home.

The Home Purchase Assistance Program gives up to $202,000 in down payment and closing assistance to eligible first-time homebuyers. Once you’ve found a house, contact your housing counselor to request a qualification letter. This letter is proof that you’re qualified to buy the home, and you’ll include it with your purchase offer.

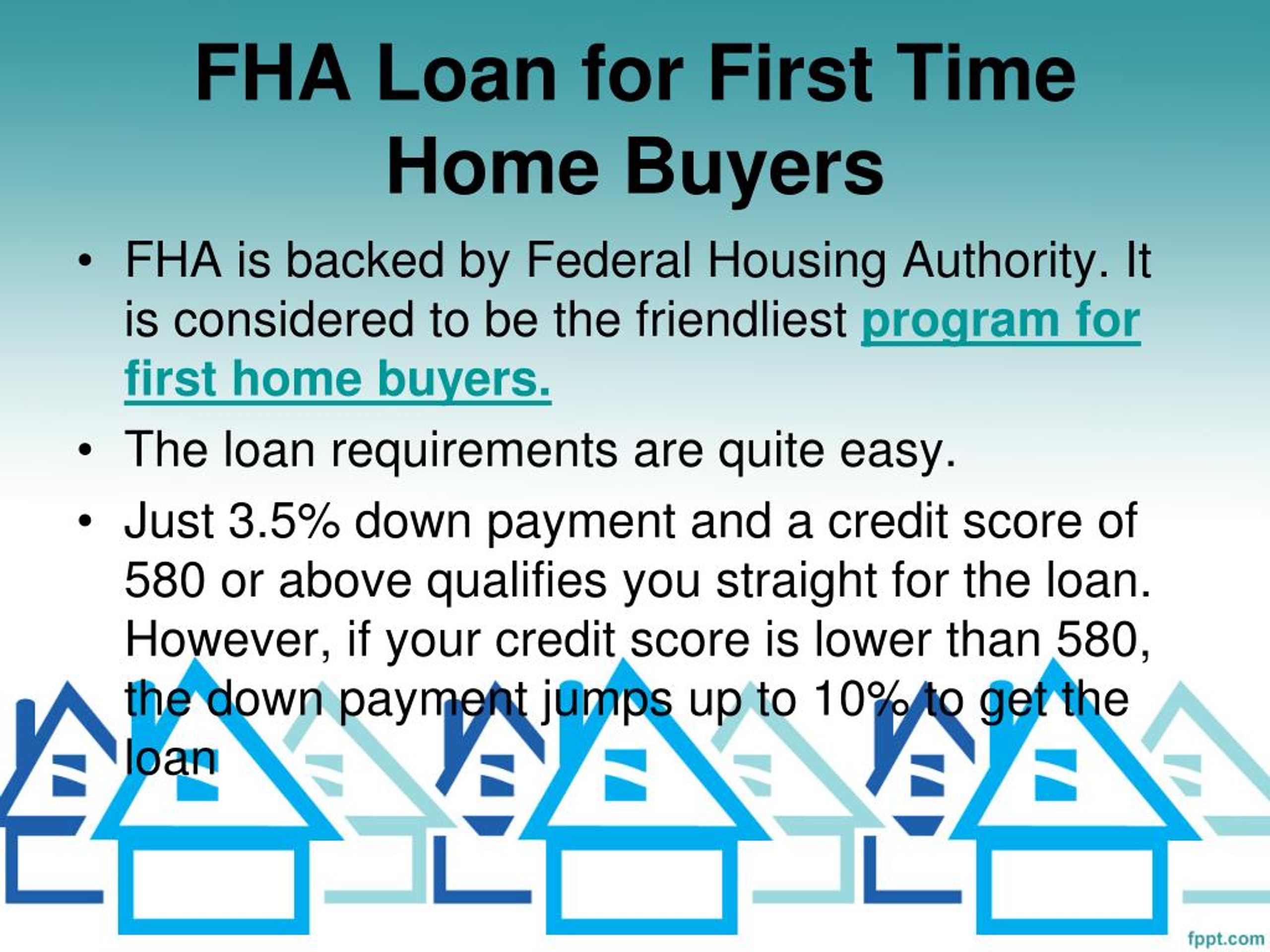

The credit score requirements for this borrowing method are much lower than other options. For their standard 3.5% down payment, you only need a credit score of 580. Now that you know what to expect, you’re ready to apply for your loan or pre-approval. As a DACA recipient, remember that no matter the lender, it’s important to ask the loan officer if the bank will approve borrowers with DACA status. By asking ahead of time, you have a better chance of avoiding problems later.

Generally, you must be part of a credit union to take a loan. Ways to get assistance with your down payment Dream of owning a house but can’t afford the down payment needed to get a home loan? 10 tips for first-time homebuyers Buying a home for the first time is a new experiences. Read our top 10 first-time home-buyer tips to help guide you through the process. Deferred Action for Childhood Arrivals is a federal program created for individuals brought to the U.S. as children who are undocumented and technically living here illegally.

While the rules for DACA eligibility for these rules were previously under question, they’ve recently been codified to support FHA loans for dreamers. At Supreme Lending Dallas, we’re immensely proud to offer DACA home loans that take your home-buying dreams and turn them into a reality. We can get you the home loan you need, just like we’ve done for many other DACA recipients.

No comments:

Post a Comment